Introduction

Long term service agreements (LTSAs) are often an attractive asset management strategy for power producing owner-operators. On the surface, LTSAs appear to be the less risky option for owner-operators when it comes to forecasting annual P&L for field repairs. However, the actual cost of maintaining and repairing field assets by owner-operators or others may be far less than the price of LTSAs offered by suppliers or service providers.

The implementation of a successful LTSA requires careful preparation, detailed analysis and understanding of the technology risk profiles of the turbines in an owner-operator’s fleet. In certain situations, an LTSA can be the best option for cost-effective O&M because of high failure risk exposure within the owner-operator’s field turbines’ components and subcomponents. If an owner-operator knows the failure risks of their assets before the end of the warranty period, they can make a more informed decision on the right maintenance strategy going forward.

In some cases, there are performance guarantees and standards for which the owner may desire changes to the scope of work over time, because corporate initiatives change based on market dynamics, shareholder pressures, and financial outlook.

Three Sectors of Turbine Operational Responsibility

1. Original Equipment Manufacturers

The OEM has intimate knowledge of the Bill of Materials within each wind turbine’s major components such as the gearbox/drivetrain. And, because they are typically the service providers during the warranty period, OEMs have historical maintenance logs and data points for action. This concept has been identified in the wind industry as the one with the “golden screwdriver,” tough to compete with when there is history that the OEM carries from turbine design to installation to operations.

In recent months, OEMs have been making LTSAs more attractive, offering lower fixed prices, no caps on major component replacements, and transitioning the turbine supplier agreements into operational agreements for long-term OEM stability. The main focus of the agreement is to ensure the owner-operator’s wind turbines are available to produce energy at a foreseeable cost within a certain period of time. This safer approach can lower annual energy production (AEP) and provide minimal options during periods of renewal or negotiation.

Opportunity Cost: As owner-operators check their boxes for budget, forecast and overall comfort level, questions remain on the missed opportunities. What’s the impact on the owner-operator’s business by not managing the valuable data and allowing OEMs to control the performance of contracted assets? Upon completion of the agreement, is owner-operator assuming control of the assets reasonable within budget requirements? If the operator understands future failure rates of the individual turbines in the fleet, is the OEM LTSA aligned with corporate objectives?

2. Independent Service Provider

The ISP could be considered the illusive “golden screwdriver” on a much smaller scale based on turbine configuration and operational depth of knowledge. Historically, ISPs have played a larger role in servicing older machines, defined by their particular operational history and ability to perform turbine service. These LTSAs generally include fixed long-term maintenance costs and contractually guaranteed or incentivized support to ensure turbine availability over the term of the agreement. The maintenance risk is placed on the ISP to keep turbines running and operational during the term of the LTSA. However, ISPs that remain risk adverse will not capture “all” turbine repairs and there will be a service cap within the scope of the LTSA. The financial responsibility of any work outside the SOW is thus transferred to the owner-operator.

As an example, within ISP LTSAs, there is a limit to the number of gearbox (or other major components) failures that will be covered in any given contract year. Over time, as the machines depreciate, accelerators in the pricing structure are triggered, increasing the projected maintenance costs budgeted.

Opportunity Cost: ISPs are more transparent with turbine information that is typically withheld by the OEM, especially as problems may arise from the machines. It’s been found that a reputable ISP will be an open book of information, resulting in a greater comfort level of operational discipline. However, limitations may be realized in engineering resources and program development for specific assets that incur higher than average failure rates.

3. Owner-Operator Self-Operation

Self-Operation can be considered one of the most cost beneficial positions, because it allows for full control of the assets – their data, operations, and maintenance activities. The main goal of this approach is to manage the asset portfolio for optimal site output, selecting right first time component upgrades based on predicted impact on life to increase turbine operation. LTSAs do not fall into this category, and generally the operators self-operating do not seek to secure a services organization.

Opportunity Cost: Self-operators need to be precise and cost conscientious with all actions taken in the field. This requires staffing subject matter experts (SMEs), or aligning with skilled vendors that can provide the type of engineering services to match corporate initiatives. Without SMEs, budgets may skyrocket beyond shareholders’ comfort levels. Digitalization to enable life extension actions that control costs and reduce failure risks becomes critical in this environment.

Taking Control During the Negotiation or Renegotiation Phase

The ability to control costs and maintain turbine performance drives the decision to move to OEM LTSA, ISP, or in-house servicing. When an owner-operator can take action with knowledge of the remaining useful life (RUL) of the major components within their turbines, their failure rates and risk exposure decreases over time. Future budget costs can be more precisely predicted and planned annually.

The Sentient Science Approach:

Wind turbines are dynamic systems exposed to aerodynamic loading and quasi-periodic excitation from the rotor – off axis moments. Structural components typically face between 100 million to 1 billion load cycles over their lifetimes. The operational environment of wind turbines is complex with turbulent wind fields, wind shear, wind veer, gusts, and wakes from surrounding turbines. Conditions can differ significantly from one geolocation to another (e.g. terrain complexity, neighboring wind farms, obstacles, atmospheric stability, etc.). Load cycles are compared to material SN-curves for the design of load carrying components of the wind turbine.

Sentient’s DigitalClone software evaluates each gear and bearing component by scientific analysis of the serialized material samples with variation. Sentient’s materials science lab performs hundreds of tests on these statistically valid number of samples, using fully representative boundary conditions including correct loads, transients, and dynamics.

Computational Testing to Understand Current and Future Remaining Useful Life and Life Extension Options

As a trusted 3rd party, Sentient provides validation and verification of the wear rates and future failure risk of each turbines’ components and subcomponents, providing in-depth analysis to identify the optimal servicing options that align with corporate objectives. Through physics-based modeling, response surface modeling and materials science, Sentient’s approach creates a risk spectrum for users to derive the failure rate of their components, which equips the owner-operator to make strategic financial and operational decision(s) based on risk verses reward.

Verification and Validation Program

Through Sentient Science’s Software as a Service (SaaS) platform, the owner-operator has the ability to compare the gear and bearing life of all vendors recommended by the OEM, soon to include all major turbine systems. This requirement will establish guidelines for using a standardized CAE tool, the same tools used in development of DigitalClone Live drivetrain models, allowing the identical site-specific wind load profiles to be used for comparison purposes. This will include provisions for exploration of fundamental architectures, gearbox life in terms of gears/bearing performance, and main bearing performance using material characteristics derived directly from the batch of the component to be installed up-tower: material microstructure, surface finish, residual stress, lubrication, etc, providing insight to action into the optimal component replacements for the site conditions.

If an owner-operator can quantify the risk profile before the end of warranty, the operator will be more informed when negotiating terms and conditions (i.e.: identifying repair/replacement vendors) with the LTSA provider. Even LTSA providers will benefit from “Buy on Life” practices by being less reactionary and more pro-active in part replacement (crane mobilization, inventory type and location, etc.) through long-term planning and supplier tradeoff analysis. They will bear less overall LTSA costs but higher margins due to this coordination, a win-win for operator and vendor.

Implementation of this program for all warranty and LTSA decisions regarding bearings, gearboxes, and other turbine systems will result in improved component installations compared to “high risk” components that are used to minimize warranty losses. In addition, long-term forecasting facilitates inventory reduction with a focused maintenance strategy.

The Business Value

Potential Value Statements for Sentient Science’s Long-term Prognostic Technology Support for LTSA/O&M Strategy and Negotiation from the Owner-Operator Perspective

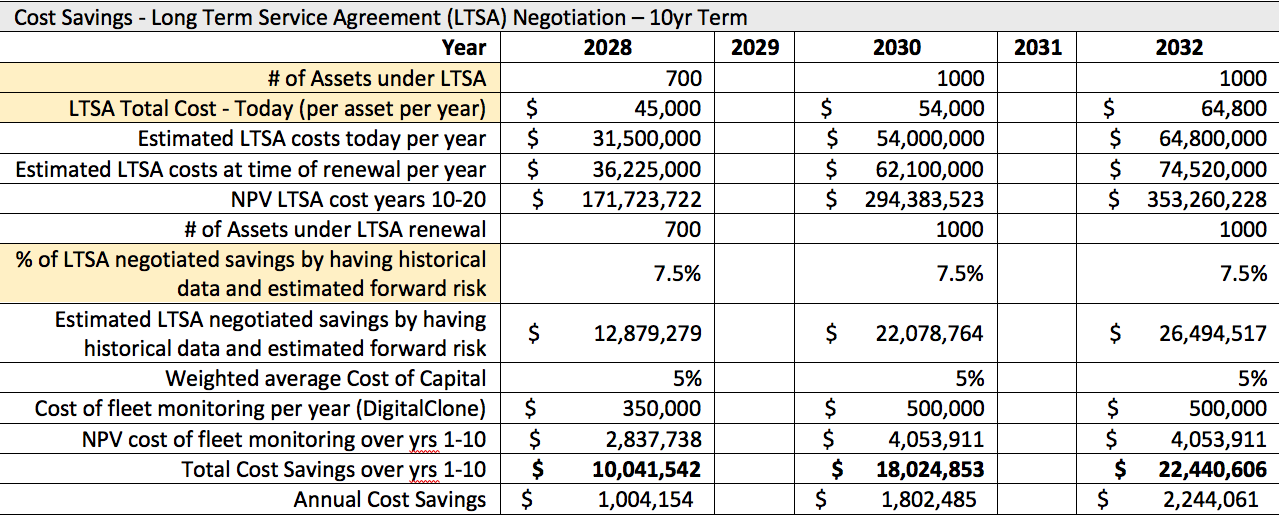

- Lower the cost of LTSA renegotiation – year over year: enhance negotiation ability between owner and operator

- Ability to retain all operational data for owner use

Hold LTSA operator accountable for work performed and for future risk of failure not impacting turbine and manifesting during contract term - Ability to operate assets per corporate requirements; Identify Serial Defect Risk prior to occurrence

Automating the failure rate forecast for tractability of operator activities

In Summary:

In closing, there are many options today for operators to shift risk. Whether they seek an independent third party to perform or allow the OEM to operate the assets through the warranty period and forward years, opportunity to secure the portfolio for the long endeavor is the current industry shift. When deciding which option is aligned with corporate initiatives, one must understand the failure rate risk of the fleet under the current site operating conditions. As a result, reviewing the available technologies is key for an informed decision.

This is where Sentient provides additional insight into the materials science-fleet assessment that can only be identified through physics-based modeling.

Sentient Science is based in Buffalo, NY with offices in Idaho Falls, ID, West Lafayette, IN, Pamplona, Spain & Beijing, China

Keith Vergien is the Vice President of Energy Operations. For more information, contact@sentientscience.com